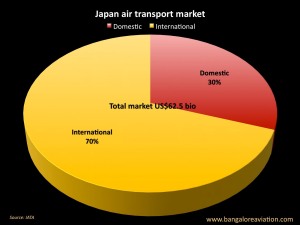

Japan, which suffered a devastating earthquake recently, has long been a major player in the air transport industry with a total market size of $62.5 billion annually.

While it is too early to assess the long-term infrastructural impact of the quake on the industry, an understanding of the industry structure in Japan can provide us with some insights.

The most immediate impact will be felt in the $19 billion domestic segment of the market which carries 83 million passengers annually. In comparison India is just around 52 million domestic passengers.

However, on the international front, Japan’s $62.5 billion annual aviation market contributes 6.5% of worldwide scheduled traffic and being considered a “high value market”, 10% of the industry’s total revenues.

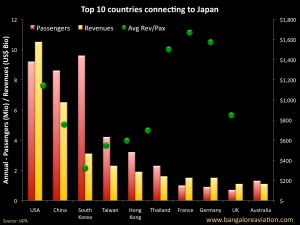

Long term impact will be felt by the countries that connect to Japan, led by the United States, China, South Korea, Taiwan, Hong Kong, and others as represented in the graph above showing the top ten countries connecting to Japan.

IATA Chief Bisignani says

“A major slowdown in Japan is expected in the short-term. And the fortunes of the industry will likely not improve until the effect of a reconstruction rebound is felt in the second half of the year,”

However, there can be a significant impact on the air transport industry in China, which is the most exposed to Japan. Japan accounts for 23% of China’s international air transport revenues.

Taiwan and South Korea follow China with Japan operations contributing 20% each. Thailand, the United States, Hong Kong follow.

With Japan contributing 9% to the Singapore air transport market, Singapore Airlines is already scaling back its flights to Japan, and has delayed the March 27th upgrade to Airbus A380 of its profitable Singapore-Tokyo-Los Angeles SQ11/SQ12 service.

Soon after the quake, many economists were suggesting that while travel markets will weaken in the short term, it would pick-up sharply as the Japanese economy re-bounded once re-construction commenced in the second half of 2011. However, the radiation problems at the Fukushima Daiichi nuclear power facility are now diluting that initial optimism.

On the manufacturing side, the Japanese aerospace industry is a major contributor to Boeing, especially on the 787 Dreamliner programme. While the major vendors are located away from the quake epicentre and therefore their facilities are not impacted, there is a rolling blackout throughout Japan and there is still no clarity on their downstream sub-vendors. This raises questions on whether there will be a further impact on this already delay plagued airplane?

What is your take on the situation both short and long term? Post a comment.